Questions On Cryptocurrency

Cryptocurrency multiple choice questions and answers on Cryptocurrency MCQ questions on Cryptocurrency questions. That’s the question that’s foremost on everyone’s mind: “Why didn’t I see this coming?” But let bygones be bygones, and focus on your attention on the questions you should be asking yourself right now, as the cryptocurrency market has altered and matured immensely since it took off at the start of the decade. What was once an. The IRS really wants to know about your cryptocurrency. For tax year 2020 the IRS moved the cryptocurrency question from Schedule 1 of the Form 1040, where it was in 2019, to the much more prominent position of Page 1 of the Form 1040 itself. The question is the second piece of information requested, right after the taxpayer’s name and address.

On the first page of the Form 1040 for 2020, right under the taxpayers’ personal information but before any financial information is reported, the IRS has added the following question: “At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”. This heightened attention is not surprising. One of the top priorities of the Internal Revenue Service (IRS) in recent years has been to discover which taxpayers are selling cryptocurrency (i.e., Bitcoin or Ethereum) without reporting the transactions on their tax returns. The IRS is also looking for taxpayers earning cryptocurrency for services provided or performed without reporting the income. The new question seems simple, but perhaps not.

If you look to the instructions for the 2020 IRS Form 1040 regarding “Virtual Currency” as guidance regarding the new question, they state the following:

“Virtual currency is a digital representation of value, other than a representation of the U.S. dollar or a foreign currency (“real currency”), that functions as a unit of account, a store of value, or a medium of exchange. Some virtual currencies are convertible, which means that they have an equivalent value in real currency or act as a substitute for real currency. The IRS uses the term ‘virtual currency’ to describe the various types of convertible virtual currency that are used as a medium of exchange, such as digital currency and cryptocurrency. Regardless of the label applied, if a particular asset has the characteristics of virtual currency, it will be treated as virtual currency for Federal income tax purposes. If, in 2020, you engaged in any transaction involving virtual currency, check the “Yes” box next to the question on virtual currency on page 1 of Form 1040 or 1040-SR. A transaction involving virtual currency includes, but is not limited to:

- The receipt or transfer of virtual currency for free (without providing any consideration), including from an airdrop or hard fork;

- An exchange of virtual currency for goods or services;

- A sale of virtual currency;

- An exchange of virtual currency for other property, including for another virtual currency; and

- A disposition of a financial interest in virtual currency.

A transaction involving virtual currency does not include the holding of virtual currency in a wallet or account, or the transfer of virtual currency from one wallet or account you own or control to another that you own or control. If you disposed of any virtual currency that was held as a capital asset through a sale, exchange, or transfer, use Form 8949 to figure your capital gain or loss and report it on Schedule D (Form 1040).

If you received any virtual currency as compensation for services or disposed of any virtual currency that you held for sale to customers in a trade or business, you must report the income as you would report other income of the same type (for example, W-2 wages on Form 1040 or 1040-SR, line 1, or inventory or services from Schedule C on Schedule 1).

For more information, go to IRS.gov/virtualcurrencyfaqs.”

It is clear that if a taxpayer sold “virtual currency” for a profit, then that taxpayer would have to pay income tax on the gain. For example, if the taxpayer sold Bitcoin during 2020 and had a gain, the taxpayer would need to check the box on page one as “Yes” and report the gain on that sale as income. However, what if that taxpayer merely purchased Bitcoin as an investment to hold as a long-term investment without selling any of it during 2020? On one hand, it would seem that the taxpayer should not have tax consequences to disclose or report because it purchased an investment and taxpayers normally do not need to report acquisitions of investments, like a publicly traded stock, in the year that it is acquired. On the other hand, the new question on the return seems to imply that you would have to check “Yes” in that case because you would have “acquired [a] financial interest in [a] virtual currency”.

Interestingly, an earlier draft of the IRS’s instructions for the 2020 Form 1040, as cited above, were different. Those instructions listed the examples of transactions involving virtual currency to include:

- A purchase or sale of virtual currency; and

- An acquisition or disposition of a financial interest in a virtual currency. (emphasis added)

When the final instructions ultimately were released, the words “purchase” and “acquisition” were removed but the phrase “otherwise acquire any financial interest” was kept in the question. In addition, the instructions still include the verbiage that the holding of virtual currency is not a reportable transaction for tax purposes. Thus, this has caused confusion in the tax community because it is unusual that merely acquiring an investment is receiving tax scrutiny. Adding to the confusion, an IRS spokesperson was quoted in a recent article in Tax Notes[1], as saying: “If the only activity someone has is a purchase/acquire and hold, then they don’t have to check the box”. Also, the FAQ page on the IRS’s website states: “No. If your only transactions involving virtual currency during 2020 were purchases of virtual currency with real currency, you are not required to answer ‘yes’ to the Form 1040 question.”

In sum, should a taxpayer check the box on page one of their form 1040 “Yes” if they purchased Bitcoin or Ethereum (or some other cryptocurrency) as an investment to hold? The 1040 instructions and the IRS seem to imply that you would not need to check “Yes”, but the question itself implies a different answer. The answer may be unclear, but one thing that is clear is that, like asking clients if they have foreign bank accounts, tax practitioners now need to be asking their clients now about their cryptocurrency holdings.

[1] Kristen A. Parillo, “Final Crypto Instructions May Send Mixed Signals,” Tax Notes Today Federal, February 8, 2021, 2021 TNTF 25-5, https://www.taxnotes.com/tax-notes-today-federal/cryptocurrency/final-crypto-instructions-may-send-mixed-signals/2021/02/08/2r46r (retrieved February 6, 2021, subscription required)

Last updated: January 5, 2021

On December 31, 2020, just before the new year, the IRS released a second draft of Form 1040 for the 2020 tax season. This second draft differed from the one released in October 2020in that it provided even further clarity as to who needs to check ‘yes’ to the virtual currency (cryptocurrency) question that now exists at the top of Form 1040:

“At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

Updated 1040 Virtual Currency Guidance

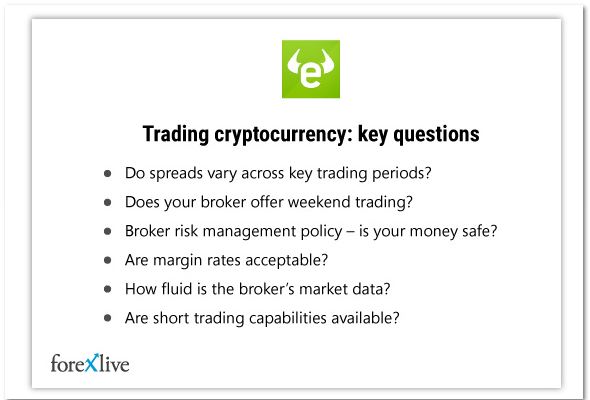

Questions To Ask About Cryptocurrency

The new guidance now declares that those who purchased cryptocurrency in 2020 (not just sold, traded, or exchanged) must answer ‘yes’ to the question.

This language was not present in the prior instructional guidance that was released in October.

The IRS will now know everyone who purchased cryptocurrency in 2020 as all taxpayers must answer this question under penalty of perjury.

<div></div>

When Must You Answer ‘Yes’ to the 1040 Virtual Currency Question?

You must answer yes to the virtual currency question if in 2020 you,

- purchased crypto

- received crypto (including if you received from an airdrop or fork)

- sold crypto for fiat currency (like USD)

- exchanged one crypto for another

- used cryptocurrency to buy goods and/or services

Keep in mind, just because you select ‘yes’ to the virtual currency tax question, does not necessarily mean you owe taxes on your crypto. For a complete breakdown of how cryptocurrency taxes work and when you do or do not owe taxes, check out our Complete Crypto Tax Guide.

When Can You Answer ‘No’ to The 1040 Virtual Currency Question?

The new 1040 instructions also clarified that you do not need to check ‘yes’ to the virtual currency question if in 2020 you only:

- held cryptocurrency in wallets or

- transferred them between their own wallets

This is valuable clarification for long-term holders who were unsure if they needed to select yes or no to the question.

The IRS Is Cracking Down on Crypto Tax Compliance

It’s clear that the IRS is cracking down on crypto tax compliance. From the tens of thousands of CP2000’s that got sent out to the updated regulation, the agency is making a huge push.

Don Fort, the chief of the Internal Revenue office, recently made a public statement explaining that the agency is switching from “education to enforcement” in 2021 as reported by CoinTelegrah.

Questions?

Questions On Cryptocurrency For Dummies

If you have any question regarding cryptocurrency taxes and your specific position, feel free to reach our tax team via live-chat on our homepage. We have been doing this for a long time and are happy to help!